Bridging the Recruiting and Promotion Gap in Investment Banking and Private Equity

Jan 12, 2026

In the high-stakes world of investment banking (IB) and private equity (PE), talent is the ultimate differentiator. Yet, systemic gaps in recruiting and promotion continue to hinder access, progression, and recognition for high-potential individuals. Drawing on 2025 industry data, this whitepaper examines data-backed trends, root causes, and actionable solutions to bridge these divides. Key findings indicate that while deal activity rebounds—with global PE deal values up 19% in H1 2025—talent bottlenecks persist, driven by pedigree biases and opaque advancement systems. By modernizing talent strategies, firms can unlock diverse pipelines, reduce turnover, and enhance value creation, while individuals gain tools to navigate competitive landscapes.

Research suggests that while investment banking and private equity firms have made strides in broadening talent pipelines, significant barriers persist, particularly for non-target school candidates and underrepresented groups. Evidence leans toward the idea that pedigree and networks often overshadow merit, leading to talent leakage and reduced firm performance. However, firms adopting data-driven, inclusive strategies are seeing improved retention and value creation.

Key Insights on Current Challenges

- Promotion pathways remain rigid, with "up or out" cultures contributing to high turnover—analysts typically advance in 2-3 years, but only about 9% of bulge bracket hires come from non-target schools, limiting diversity at entry levels.

- Underrepresentation in senior roles is stark: women hold just 29% of C-suite positions globally, with even lower figures for minorities, highlighting systemic biases in progression.

- Private equity faces talent shortages amid rising demand for operational expertise, with 2025 trends emphasizing AI integration and sector specialization to drive value.

Why This Gap Persists Structural signals like school prestige and sponsorship heavily influence access and advancement. For instance, non-target candidates must network extensively to overcome filtering biases, while promotion decisions often favor relational networks over pure performance metrics. This not only shrinks the talent pool but also increases costs—turnover in mid-level roles can erode EBITDA gains in PE portfolios.

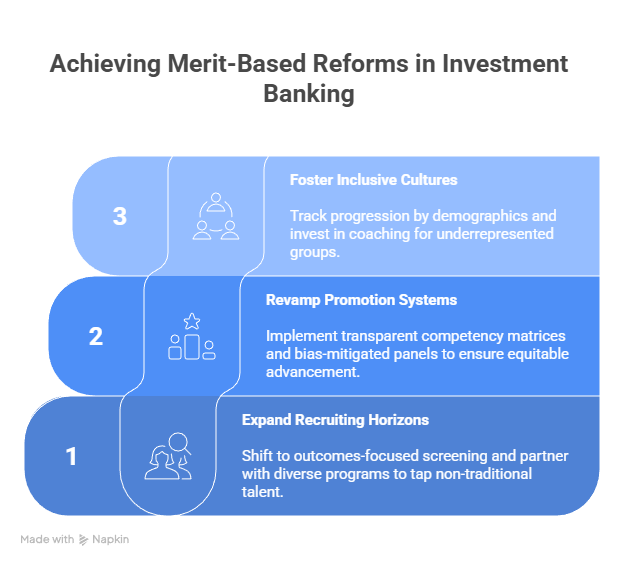

Actionable Solutions for Firms To bridge this, firms should prioritize merit-based reforms:

- Expand Recruiting Horizons: Shift to outcomes-focused screening, partnering with diverse programs to tap non-traditional talent.

- Revamp Promotion Systems: Implement transparent competency matrices and bias-mitigated panels to ensure equitable advancement.

- Foster Inclusive Cultures: Track progression by demographics and invest in coaching for underrepresented groups.

Strategies for Individuals Aspiring professionals can build competitive edges by:

- Crafting quantifiable narratives of impact (e.g., "Optimized models boosting deal efficiency by 15%").

- Pursuing high-ROI skills like financial modeling and sector expertise via targeted internships.

- Mapping alternative paths, such as boutiques or corporate finance, as gateways to elite roles.

As markets evolve in 2025, aligning talent strategies with performance predictability isn't just equitable—it's a strategic imperative for sustained value creation. What are your experiences navigating these gaps? Share in the comments.

Introduction: The Talent Imperative in Finance

Investment banking and private equity operate in environments where execution excellence directly impacts returns. However, access to these careers often hinges on structural signals—elite school pedigrees, internal sponsorships, and networking prowess—rather than pure merit. This misalignment not only overlooks capable talent but also undermines firm competitiveness. For instance, amid talent shortages, 93% of finance leaders report difficulties hiring qualified professionals in 2025, exacerbating gaps in operational roles critical for PE value engines.

This whitepaper synthesizes recent data from sources like McKinsey, Bain, and industry surveys to highlight hard trends (e.g., promotion timelines) and soft realities (e.g., bias in "fit" assessments). It proposes solutions through a Value Creation Integration Index (VCII) lens, emphasizing how inclusive talent practices can drive EBITDA uplift and premium exits.

Section 1: Promotions and Career Progression Realities

Investment banking careers adhere to a hierarchical structure: Analyst → Associate → Vice President (VP) → Director/Executive Director (ED) → Managing Director (MD). This "up or out" model, where professionals must advance within set timelines or exit, remains prevalent despite efforts to incentivize retention.

Hard Data on Banking Promotion Trends

- Analyst Level: Typically 2-3 years before promotion to Associate, with top performers accelerating via strong deal involvement.

- Associate Level: 3-4 years to VP, shifting focus from execution to client management.

- VP Level: 3-4 years to Director/ED, emphasizing business development.

- Director/ED to MD: 2-3 years on average, though highly variable based on revenue generation; total timeline from Analyst to MD often spans 12-15 years.

- Recent shifts include "junior MD" titles at some banks, diluting traditional payoffs and sparking scrutiny over meritocracy.

Soft Realities Beyond metrics, promotions rely on visibility and sponsorship. Relational networks often tip the scales, with subjective evaluations favoring incumbents. This contributes to high attrition: mid-level bankers frequently exit for PE or tech roles, citing opaque criteria. In PE, progression is even more competitive, with flat structures limiting upward mobility and emphasizing post-MBA recruiting.

| Promotion Level | Typical Timeline | Key Responsibilities | Common Barriers | Compensation Range (USD, 2025) |

|---|---|---|---|---|

| Analyst | 2-3 years | Modeling, pitch books, research | Lack of sponsorship | $190K-$240K total |

| Associate | 3-4 years to VP | Team management, client comms | Network gaps | $300K-$450K total |

| VP | 3-4 years to Director | Deal origination, strategy | Performance subjectivity | $400K-$600K+ total |

| Director/ED | 2-3 years to MD | Leadership, revenue focus | Politics and bias | $500K-$800K+ total |

| MD | N/A (top role) | Firm-wide decisions | Market conditions | $1M+ total |

Section 2: Non-Target Recruiting and Structural Barriers

Candidates from non-target schools—those without proactive bank recruiting—face steep hurdles, with statistics underscoring the divide.

Systemic Barriers

- At bulge brackets, 65% of analyst hires come from target schools (e.g., Ivies), 26% from semi-targets, and just 9% from non-targets. Elite boutiques skew even higher toward targets (80%+).

- PE recruiting is cyclical, favoring IB feeders or top consulting backgrounds, reinforcing target advantages.

- Recruiters often filter by pedigree, limiting interview access despite equivalent skills; non-targets report needing 2-3x more networking efforts.

Soft Realities "Fit" assessments embed cultural biases, disadvantaging those without institutional narratives. Diversity programs help, but anecdotal evidence shows they sometimes prioritize quotas over holistic merit, frustrating all applicants.

Section 3: Implications for PE and Value Creation

Talent constriction directly impairs PE's core function: operational value realization. Bottlenecks inflate turnover costs—estimated at 1.5-2x salary per exit—and widen performance gaps. Poor progression suppresses mid-level retention, leaking experienced talent before senior roles. In 2025, with AI and ops talent in demand, firms ignoring these gaps risk suboptimal exits.

Section 4: Root Causes

Structural Inputs

- Academia Bias: Heavy reliance on degree brands; non-targets seen as higher risk.

- Promotion Politics: Subjective decisions reward tenure over impact.

- Network Effects: Referrals dominate, sidelining outsiders.

Outcome Effects

- Talent shifts to tech/asset management.

- Diversity lags: Women at 29% in senior finance roles; minorities at 9% in C-suites.

| Root Cause Category | Examples | Impact on Talent Pool | Mitigation Potential |

|---|---|---|---|

| Academia Bias | Target school filtering | Shrinks diversity | High (via blind screening) |

| Promotion Politics | Sponsorship dependency | High turnover | Medium (transparent metrics) |

| Network Effects | Referral dominance | Underrepresentation | High (diverse panels) |

Section 5: Data-Informed Solutions (VCII Lens)

For Firms: Structural Fixes

- Expand Beyond Pedigree: Use case-based screening; partner with boutiques/regional programs.

- Transparent Frameworks: Competency dashboards tying progression to outcomes like client wins.

- Bias-Mitigated Panels: Diverse reviewers; track cohorts by background.

- Talent Bench Mapping: Rotational programs for non-traditional paths.

For Individuals: Strategic Playbook

- Visible Value Signals: Quantify impacts in resumes (e.g., EBITDA improvements).

- Structured Networking: Target recruiters/alumni with tailored outreach.

- Skills Stacking: Master modeling, negotiation; pursue certifications.

- Portfolio Mapping: Use boutiques as accelerators.

Section 6: Future Outlook

By 2025's end, scrutiny on compensation and titles will intensify, with PE prioritizing AI-fluent operators for resilience. Merit-focused reforms promise strategic edges, turning talent equity into a value multiplier.

Conclusion

Bridging these gaps requires commitment to data-driven inclusivity. Firms embracing VCII principles will not only foster fairness but also secure competitive advantages in an evolving market.

Key Citations

- Mergers & Inquisitions: IB Career Path

- PrepLounge: IB Guide 2025

- 300Hours: IB Hierarchy

- M&A Community: PE vs. IB

- IB Interview Questions: Non-Target Strategy

- M&A Community: PE Recruiting Timeline

- Financial Edge: Talent Shortage

- Reddit: Diversity Recruiting

- LinkedIn: Breaking into IB

- McKinsey: Women in the Workplace 2025

- HouseBlend: 2025 Job Market

- ZipDo: DEI in Finance

- CBH: PE Talent Strategies

- Aura: PE Hiring Trends

- NU Advisory: PE Trends

- Accenture: PE Trends 2025

- M&A Community: Mastering PE Recruitment

- Growth Equity Guide: How to Get into PE

We have many great affordable courses waiting for you!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.