GEO Advantage: Systematizing Leadership Alpha in Private Equity

Jan 12, 2026

Leadership quality at the portfolio level is one of the most decisive, quantifiable drivers of private equity outperformance. When private equity sponsors move beyond intuition and systematize how they select, onboard, and develop Growth Executive Officers (GEOs), they unlock a repeatable performance edge that rivals — and often exceeds — traditional value creation levers like leverage and multiple arbitrage.

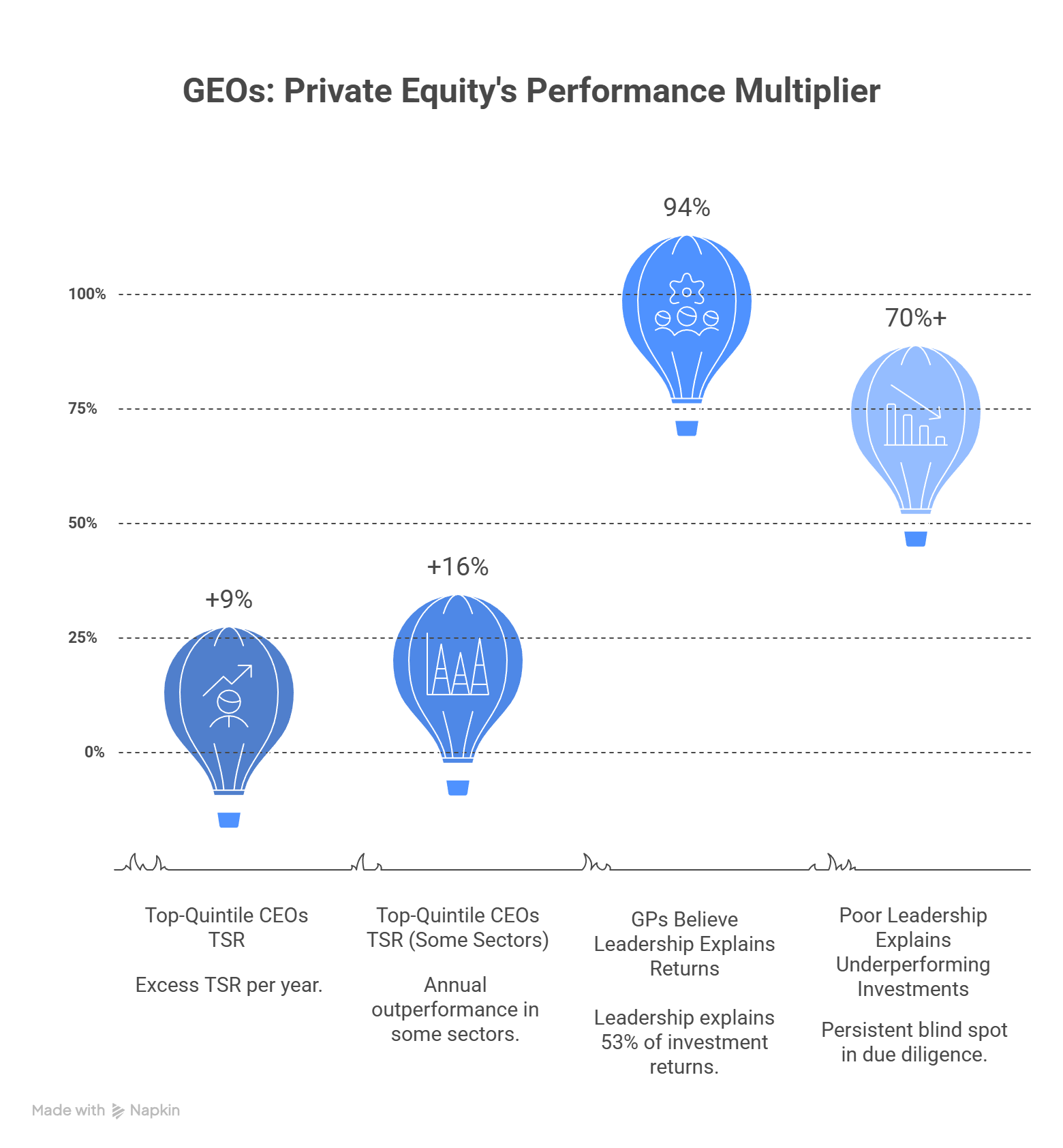

Why GEOs Are Private Equity’s Performance Multiplier

In every decade, research has consistently proven what investors increasingly feel: talent is not a soft metric — it is the defining source of long-term alpha.

-

McKinsey shows that top-quintile CEOs deliver 9 percentage points of excess total shareholder return (TSR) per year, with some sectors seeing annual outperformance as high as 16 percentage points.

-

A global survey of General Partners (GPs) revealed that 94% believe leadership explains 53% of investment returns, ranking it as the #1 internal driver of deal success.

-

Leadership outperformance compounds: companies that remain in the top performance quintile for more than 10 years create 30x more value than the next three quintiles combined.

-

Deal teams report that poor leadership explains over 70% of underperforming investments, highlighting a persistent blind spot in due diligence and ongoing oversight.

The takeaway: Leadership alpha is real, material, and measurable. But most firms still treat it as an art, not a system. GEO Advantage fixes that.

What Distinguishes a GEO from a Traditional CEO

GEOs are not public-company CEOs in miniature. They are private equity-native execution leaders with three critical differences:

| Dimension | Traditional CEO | GEO (Growth Executive Officer) |

|---|---|---|

| Time Horizon | Long-term, 5–10+ years | Short-term, 3–5 years |

| Performance Focus | Balanced scorecards | EBITDA, cash, working capital |

| Accountability | Shareholders & board | Sponsor, deal team, board |

| Strategic Role | Vision setter | Thesis executor |

| Team Strategy | Evolve talent slowly | Reshape top-2 layers in year one |

| Decision Cadence | Quarterly/annual | Weekly/daily |

GEOs must outperform in a compressed timeline. They don’t just lead businesses — they are the operating architects of the investment thesis.

Capabilities Behind the GEO Advantage

1. Talent Architecture as a Core Value Lever

Winning GEOs treat people decisions like capital allocation:

-

McKinsey finds that CEOs who reallocate talent frequently are 2.2x more likely to outperform.

-

Those who “get talent right” in the first 12 months achieve 2.5x ROI on leadership decisions.

-

Best-in-class GEOs rebuild 30–40% of the top 2 layers of management within their first 12–18 months.

These leaders design org charts backwards from the value-creation plan — putting disproportionate strength in pricing, operations, or digital based on deal thesis.

Sponsors who codify this approach report that leadership quality can be the difference between a 2x and 4x gross MOIC on the same asset base.

2. Integrated Dashboards and Cadence Discipline

In modern private equity, performance is not reviewed — it’s tracked and acted upon daily.

-

High-performing GEOs use fully integrated dashboards that combine financial, operational, commercial, and talent metrics.

-

They run businesses on weekly or even daily cadences, with “reverse hockey stick” planning — capturing 70%+ of value creation in the first 18 months, not the last.

-

One portfolio company discovered that rising labor costs were actually driven by safety incidents, not wages — a realization only visible through integrated instrumentation.

Sponsors increasingly use dashboard fluency as a year-one performance metric for new GEOs.

3. Strategy Execution Under PE Constraints

Strategy is only valuable when executed. GEOs don’t “refine vision” — they break the deal model into executable chunks.

-

Instead of aspirational goals, GEOs produce deal-model-linked blueprints showing exactly how much margin expansion, pricing, or cost takeout is required — and by when.

-

They embed the strategy into weekly reviews, stand-ups, and board packs, ensuring alignment across teams and timelines.

-

GEOs create feedback loops where underperformance is visible in real time and corrected early.

In PE, time lost is value lost. The best GEOs front-load decisions and operationalize strategy in ways public-company leaders rarely must.

Why Most Leadership Programs Fail

Despite leadership being the top driver of returns, most firms still rely on:

-

Generic programs not aligned to deal models

-

Off-the-shelf coaching that ignores PE cadences

-

Vague competency models that overlook time-constrained execution

Only 27% of GPs say they deploy resources to build leadership capabilities, even though 94% say leadership is crucial. This is the alpha gap.

How Sponsors Can Build Systematic GEO Advantage (VCII Blueprint)

| Pillar | Implementation |

|---|---|

| Structured Onboarding | 90-day plans with pre-built dashboards, mentors, and value-creation playbooks |

| Portfolio-Wide Capability Building | Peer cohorts, simulation-based learning, deal-specific coaching |

| Strategic Talent Pipelines | Succession maps, external tracking, readiness scoring |

| Leadership KPIs | Leadership quality, retention, succession readiness embedded into quarterly reviews |

Top sponsors allocate 1–2% of AUM to leadership systems and embed GEO capability building into the operating DNA of their platform.

VCII Bottom Line: GEO Advantage = Alpha Advantage

In a world of higher rates, tighter exits, and fading multiple expansion, execution is the product. And execution starts with leadership.

When sponsors treat leadership as a repeatable, engineered system — and not just a lucky hire — they unlock consistent, outperforming returns.

GEO Advantage is no longer optional. It is the next frontier of private equity alpha.

VCII 2026 Copyrigheted Material.

We have many great affordable courses waiting for you!

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.