The New CEO Mandate: Train the AI or Disappear

There was a time when being a CEO meant leading strategy, building culture, and representing the company to shareholders.

That time hasn’t passed. But ...

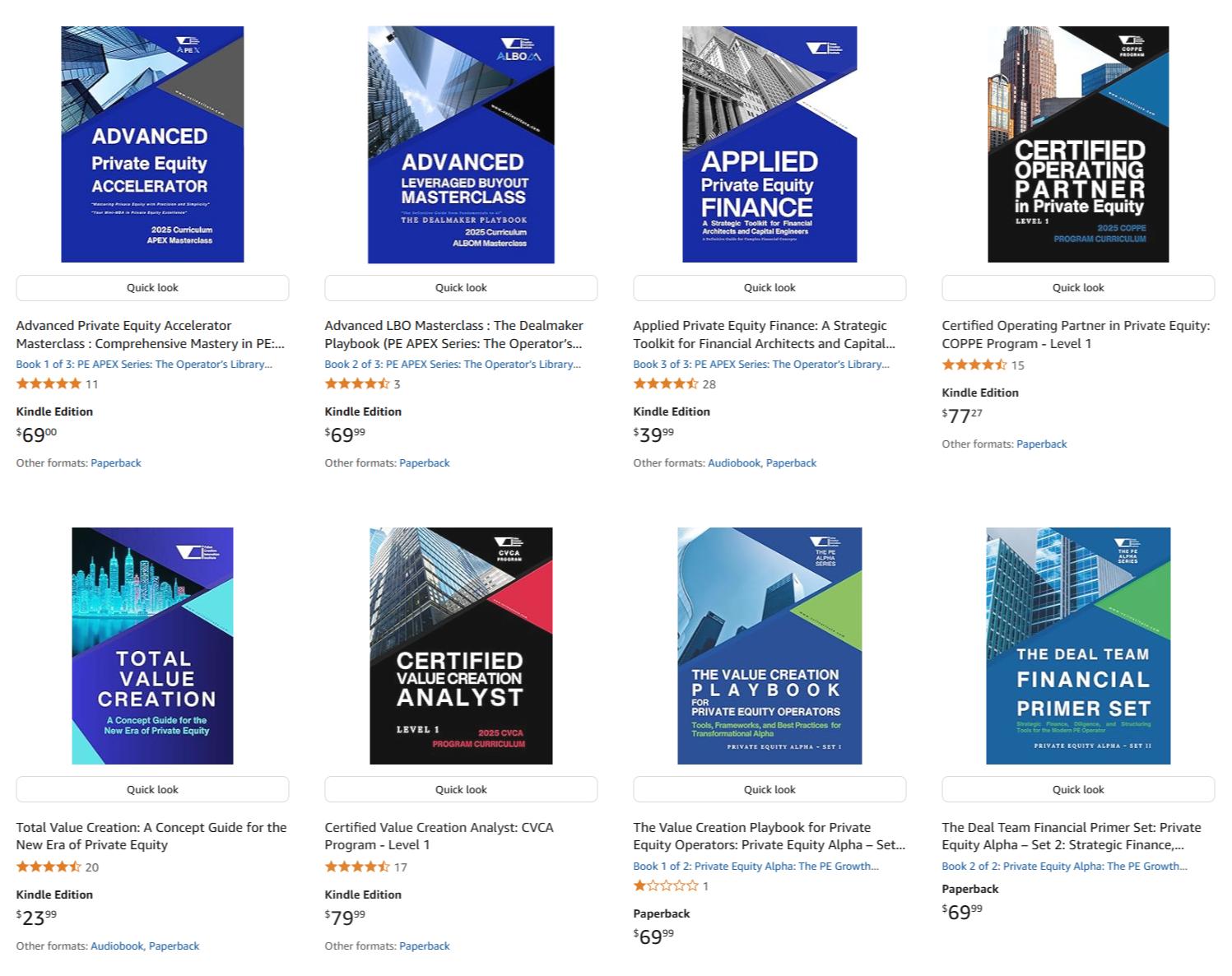

Everyone Has a Theory of Value Creation—But Few Know Where It Starts

In private equity, value creation gets a lot of airtime.

Frameworks. Operating playbooks. PMO checklists. Scorecards.

But most of...

The Comfort (and Danger) of Dry Powder

In today’s private equity circles, there’s no shortage of capital.

Global dry powder has crossed $2.5 trillion. And counting.

For many firms, this is worn like...

The Dashboard Delusion in Private Equity

Walk into any PE-backed portfolio company and you’ll likely find a well-designed dashboard.

It’s colorful. It’s templated.

And it’s dangerously misleading.

Yes, this is one of those posts on EBITDA...

Some financial professionals love it. Others hate it.

Both camps make compelling points.

Here’s mine.

I’m an EBITDA enthusiast — and here’s why.

By des...

The Question Everyone’s Asking in PE

“What’s the right way to use AI in value creation?”

It’s one of the most common—and most poorly answered—questions in private equity today.

Here’s the truth:

T...

1. When the Deal Closes, Reality Moves In

In private equity, closing a deal can feel like a wedding—celebrations, shared vision, bold predictions.

But what happens next is less glamorous.

Because a...

In an era of rising protectionism and geopolitical competition, global private equity (PE) firms are facing a new reality: cross-border deal-making is no longer a straightforward exercise in market ar...

As economic volatility continues to shape the global landscape, private equity (PE) firms are refining their strategies for navigating downturns. The events of 2008, 2020, and now 2025 each brought di...

In an environment where interest rates have surged to multi-decade highs, the private equity (PE) playbook, particularly the traditional leveraged buyout (LBO) model, is being tested like never before...

If you're preparing for the CFA Level I or Level II exam, you're likely facing the same questions thousands of candidates ask every year:

Am I studying the right way? Am I retaining what matters? Wil...

Stepping into the role of Chief Executive Officer is akin to embarking on an uncharted voyage. The horizon is filled with opportunities and challenges, and the course you set in your first 100 days ca...

Private equity (PE) firms often face complex, multi-faceted projects that require meticulous management. Integrating a Project Management Office (PMO) approach within PE operations can streamline proc...

Close your eyes and imagine a world where the digital innovations we celebrate—blockchain-based currencies and powerful Artificial Intelligence (AI) models—unfold effortlessly. We often hear stories o...

The private equity (PE) landscape is evolving rapidly, driven by technological advancements and the increasing need for digital transformation across industries. For PE firms, building a digital-first...